Top 6 Accounting Challenges Small Businesses Face

- Lorraine Aquino

- Jul 3, 2025

- 4 min read

Updated: Jul 25, 2025

Running a small business comes with various challenges, and managing finances is one of the most crucial. A solid accounting system can mean the difference between success and failure. Understanding these financial hurdles can help entrepreneurs navigate complex decisions and keep their businesses on track. In this blog, we will walk you through the top six accounting challenges small business owners often face and how to overcome them.

1. Managing Cash Flow

One of the most common accounting challenges small businesses face is managing cash flow. Cash flow refers to the movement of money into and out of a business, and it directly impacts a company’s ability to operate effectively. Without adequate cash flow, small businesses may struggle to pay for everyday expenses such as payroll, rent, and inventory.

Why it’s a challenge: Small businesses often deal with inconsistent income streams. Payments from clients may be delayed, and unexpected expenses can arise. When cash inflows are irregular, it can be difficult for business owners to maintain a steady flow of capital, leading to potential shortfalls.

How to overcome it: Business owners can implement cash flow forecasting to anticipate potential shortages. This involves tracking both expected income and expenditures to predict any potential gaps. Establishing clear payment terms with clients and managing business expenses more properly can also help mitigate cash flow issues.

2. Understanding Tax Obligations

Taxes can be a complex area for small business owners to navigate, especially when it comes to understanding what taxes need to be paid and when. Different types of taxes apply to businesses, such as income tax, sales tax, payroll tax, and self-employment tax. For small businesses, the sheer number of tax regulations can be overwhelming.

Why it’s a challenge: Tax laws are constantly changing, and small business owners may not always be up-to-date with the latest requirements. In addition, small businesses may lack the resources to hire full-time accounting professionals who can manage these taxes effectively.

How to overcome it: Hiring a qualified accountant or using tax software can alleviate some of the stress around tax compliance. Additionally, staying informed about current tax regulations and creating a system to track expenses can make tax filing smoother and help avoid penalties.

3. Inaccurate Financial Records

Inaccurate financial records are another major challenge that many small businesses encounter. Proper accounting relies on accurate financial data, and when that data is wrong, it can lead to poor decision-making, missed opportunities, and even legal trouble.

Why it’s a challenge: Small business owners often juggle multiple roles and may not have the time or expertise to maintain accurate financial records. Even small errors in bookkeeping can lead to significant discrepancies that affect overall financial health.

How to overcome it: Establishing a routine for regular record-keeping is necessary. Business owners should either invest in accounting software or hire a professional to make sure that financial records are consistently updated and accurate. Additionally, conducting regular audits can help catch and correct errors early.

4. Handling Payroll

Payroll is a critical aspect of accounting that small businesses often find challenging. Ensuring employees are paid accurately and on time is important for maintaining morale and compliance. However, calculating payroll taxes, benefits, and overtime can be complex, especially as a business grows.

Why it’s a challenge: As businesses expand, the number of employees increases, which means payroll becomes more complicated. Business owners must also stay on top of changing payroll laws and tax rates, which can vary depending on the state or country in which the business operates.

How to overcome it: Small businesses can consider using payroll software to automate calculations and ensure compliance with tax laws. Outsourcing payroll to a professional service is another option for business owners who want to save time and avoid costly mistakes.

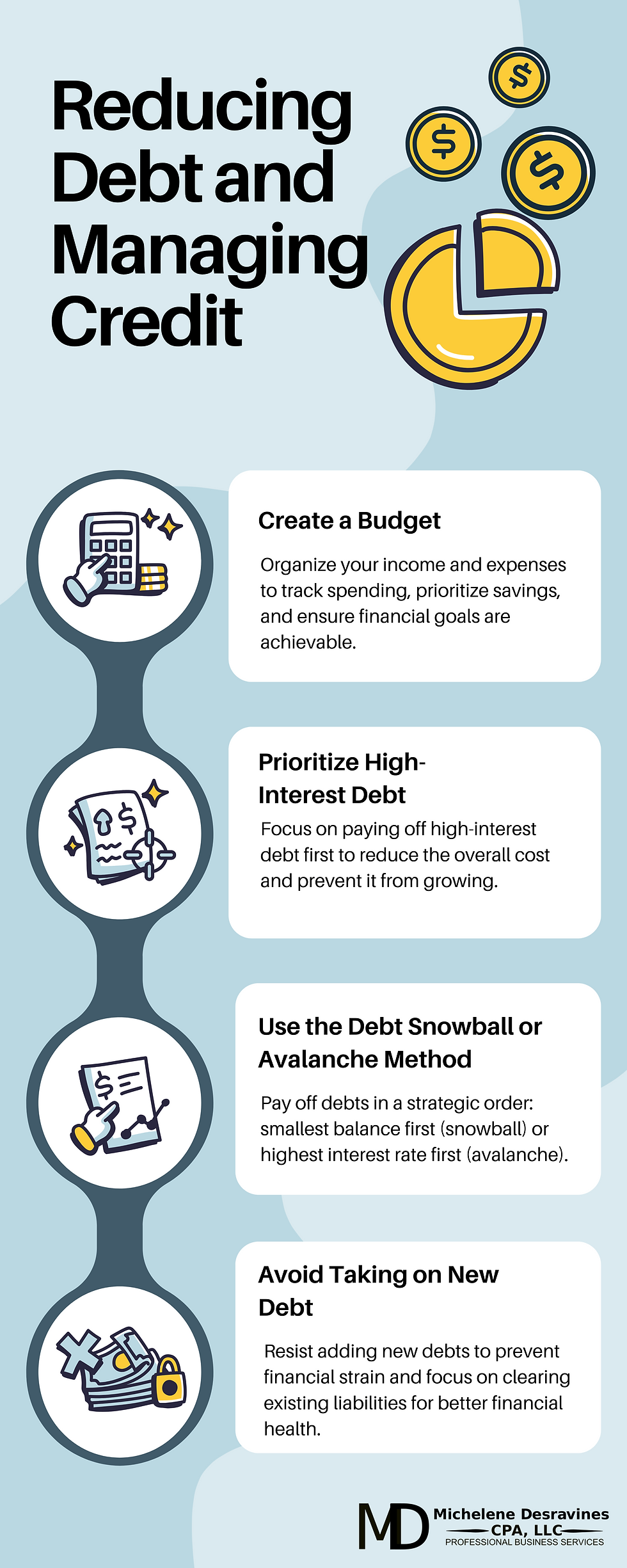

5. Managing Debt and Loans

Small businesses often rely on loans to finance operations, growth, or expansion. However, managing debt and understanding how it impacts the business's overall financial health can be difficult. Many small business owners struggle with balancing the need for capital with the ability to repay debts without overextending themselves.

Why it’s a challenge: If debt levels get too high, businesses may face financial difficulties, including the inability to repay loans or meeting interest obligations. This can negatively affect cash flow and even damage the company’s credit score.

How to overcome it: To manage debt, small businesses should prioritize paying off high-interest loans first and make sure they have a plan for repaying any outstanding debts. Business owners should also explore options such as consolidating loans or renegotiating terms to improve their financial position. Regularly reviewing and adjusting the business’s budget can help prevent unnecessary borrowing.

6. Financial Forecasting and Budgeting

Effective financial forecasting and budgeting are crucial for long-term business success. However, creating accurate forecasts and budgets is often a significant challenge for small businesses. Without clear financial projections, a business may face unexpected expenses, missed growth opportunities, or even fail to meet financial goals.

Why it’s a challenge: Small businesses may not have the data or experience needed to make accurate financial predictions. Additionally, external factors, such as market conditions and customer behavior, can be unpredictable, which complicates forecasting efforts.

How to overcome it: To create reliable financial forecasts, business owners should analyze past financial data and identify trends. Using budgeting software can help track expenses and income, allowing owners to set realistic goals. It’s also important to revisit the budget periodically to make adjustments based on current conditions.

Conclusion

Accounting challenges are an inevitable part of running a small business, but they don't have to hinder progress. By understanding the common issues such as managing cash flow, tax obligations, and inaccurate records, small business owners can implement strategies to tackle them head-on. With the right tools, resources, and planning, businesses can navigate these challenges and position themselves for success.

Comments